Understanding the Significance of Bookkeeping Services

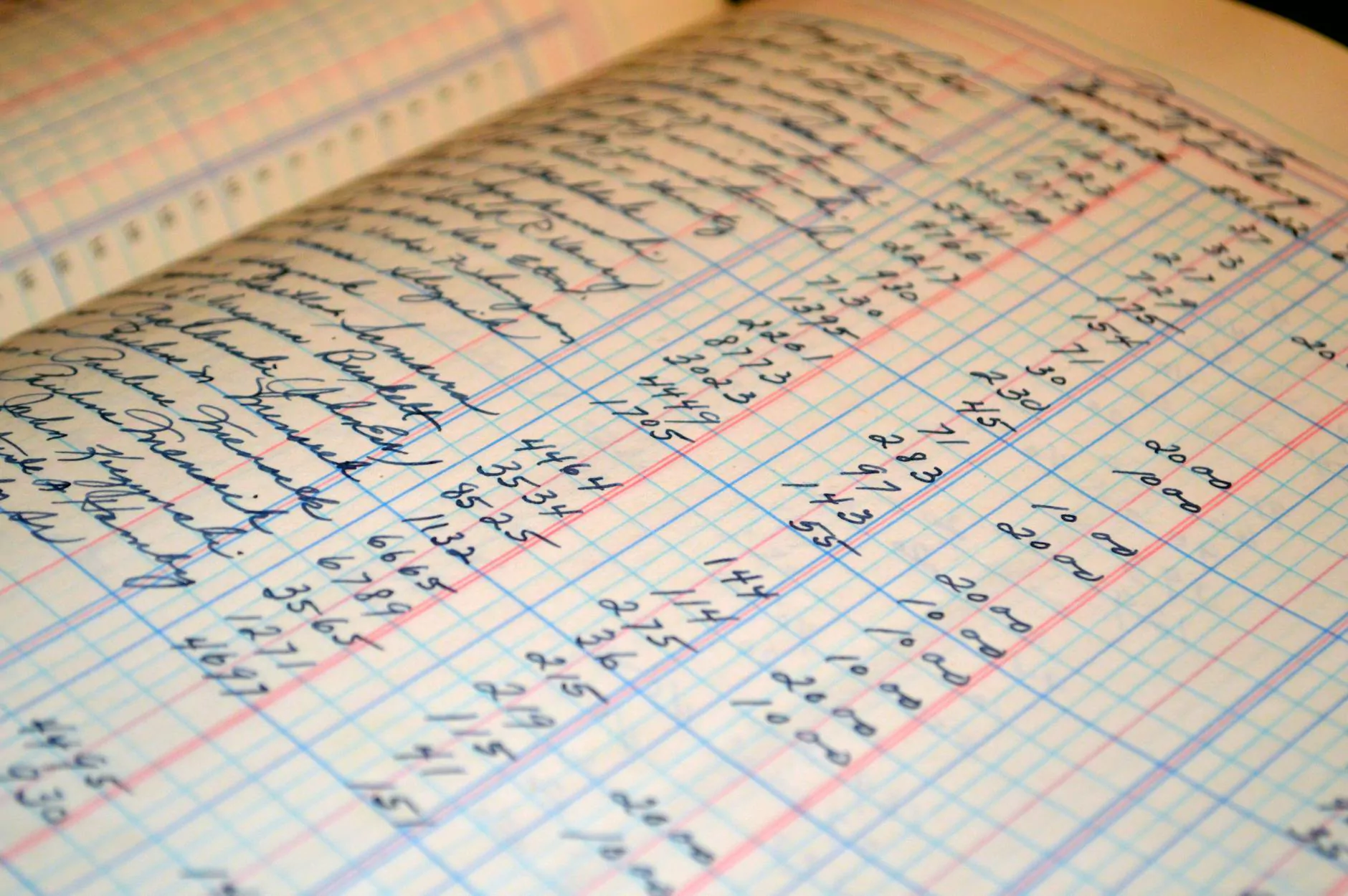

In today's fast-paced business environment, maintaining accurate financial records is more critical than ever. Bookkeeping services play a crucial role in ensuring your business's financial health. From tracking income and expenses to preparing for tax season, effective bookkeeping can significantly impact your organization’s efficiency and bottom line.

What are Bookkeeping Services?

Bookkeeping services encompass a range of tasks and practices involved in managing business accounts. These tasks can be performed in-house or outsourced to professional accounting firms. Some common duties involved in bookkeeping include:

- Recording Financial Transactions: Maintaining accurate records of all financial transactions.

- Account Reconciliation: Ensuring that bank statements match your financial records.

- Managing Accounts Payable and Receivable: Tracking money owed to and by the business.

- Payroll Management: Overseeing employee payments and tax deductions.

- Tax Preparation: Preparing documents needed for tax filings and ensuring compliance with tax regulations.

The Importance of Effective Bookkeeping

Effective bookkeeping is vital for several reasons:

1. Informed Decision Making

Bookkeeping provides a clear picture of your business’s financial status. By maintaining accurate records, business owners can make informed decisions based on real data. This might include:

- Identifying areas for cost reduction.

- Determining which products or services are most profitable.

- Evaluating cash flow and revenue trends.

2. Enhanced Financial Transparency

Having organized and accurate financial records enhances transparency. This is particularly important when it comes to:

- Investor Relations: Investors require transparent reporting to assess risk and make investment decisions.

- Regulatory Compliance: Authorities may require businesses to present detailed financial records during audits.

3. Tax Compliance

Failing to keep up with tax regulations can lead to significant penalties. Bookkeeping services ensure that all financial data is accurately recorded and available for tax purposes, helping to:

- Minimize tax liabilities through proper deduction claims.

- Prepare necessary documentation ahead of tax deadlines.

4. Improved Cash Flow Management

By tracking receivable and payable accounts accurately, businesses can avoid cash shortages that may hinder operations. Proper bookkeeping helps in:

- Forecasting future cash flow needs.

- Identifying overdue payments and managing collections more effectively.

How to Choose the Right Bookkeeping Service

When seeking bookkeeping services, it's essential to consider several factors to ensure you choose the right partner for your business. Below are criteria that can guide your decision:

1. Experience and Reputation

Look for a bookkeeping service with a proven track record. Research reviews, testimonials, and case studies to gauge their reputation in the industry. A reputable firm will:

- Have experience in your specific industry.

- Provide references from previous clients.

2. Range of Services Offered

While some businesses may only need basic bookkeeping services, others might require comprehensive financial solutions. Ensure that the service you choose can cater to your specific needs, including:

- Tax consulting.

- Financial planning and advising.

3. Technology and Tools

In today’s digital age, effective bookkeepers leverage technology to streamline their processes. Inquire about the tools they use, such as:

- Cloud-based accounting software.

- Automated invoicing and payment systems.

4. Communication and Support

Choose a service that prioritizes communication. This includes regular updates on your financial status and prompt responses to any inquiries you may have. A dedicated account manager can enhance this relationship.

Financial Advising and Bookkeeping: A Perfect Synergy

At Booksla, we offer an integrated approach that combines bookkeeping services with financial advising. This synergy is beneficial for businesses looking to optimize their financial strategies. Our team not only keeps your books in order but also provides insights on:

- Investment Opportunities: Identifying areas to invest for growth.

- Cost Management: Advising on reducing overhead and improving margins.

Common Mistakes to Avoid in Bookkeeping

Even with the best of intentions, mistakes can happen. Below are some common pitfalls to avoid:

1. Neglecting to Keep Records Current

One of the biggest mistakes is failing to keep financial records up to date. This can lead to:

- Incomplete financial reports.

- Difficulty during tax season.

2. Mixing Personal and Business Finances

Keeping personal and business finances separate is crucial. Mixing these can create confusion and make it challenging to track business performance accurately.

3. Ignoring Software Updates

Using outdated accounting software can jeopardize the security and integrity of financial data. Always ensure your tools are up-to-date to leverage new features and enhanced security measures.

Conclusion

Investing in bookkeeping services is an essential step for any business looking to thrive in today’s competitive landscape. The importance of accurate record-keeping cannot be overstated; it lays the foundation for strategic planning, compliance, and financial stability.

At Booksla, we understand that every business has unique financial needs. Our team of experts is dedicated to providing customized bookkeeping and financial advisory services that align with your business goals. With our sophisticated solutions, you’ll be empowered to focus on what you do best: growing your business.

For more information on how our bookkeeping services can benefit your business, reach out to us today!